Mon 15-04-2019

Hi everyone, hope you are all ok.

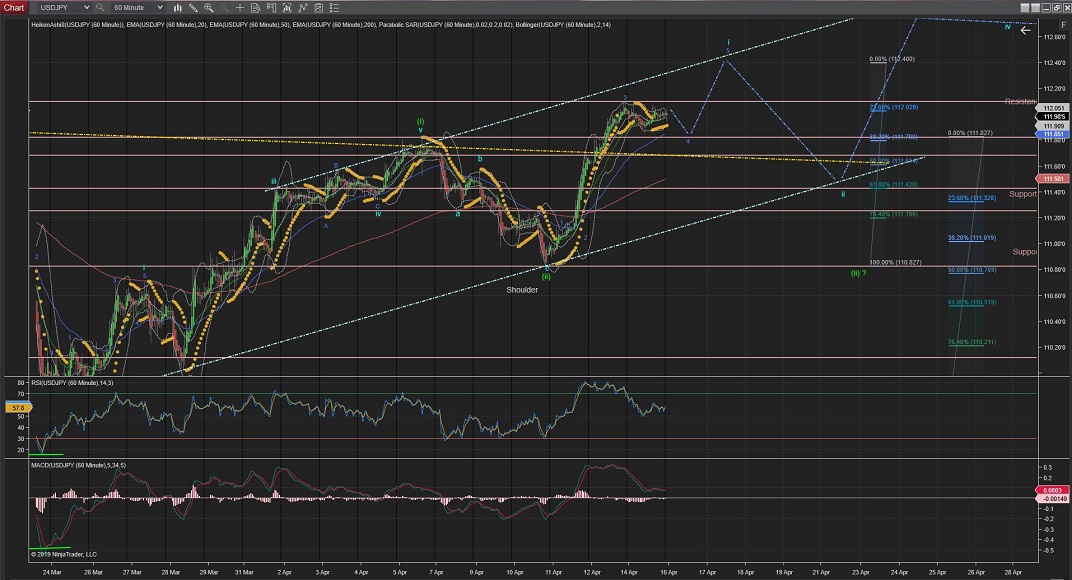

USDJPY

USDJPY is currently going through Wave 4 (blue) of Wave i, and yet to cross the big resistance levels at 112.10.

Once Wave 4 completes, Wave 5 should complete Wave i of (iii) and Wave ii correction lower would take over.

The target for Wave i is to reach the top trend line (light-blue) around the 112.40 area and Wave ii correction to retrace %50 of Wave i back towards the Head & Shoulder Neckline (yellow).

There is a lot of attention on this Head & Shoulder formation and once it breaks through, if this count is correct it will be a long run for Wave (iii) upwards.

60Mins

4Hours

Daily

Weekly

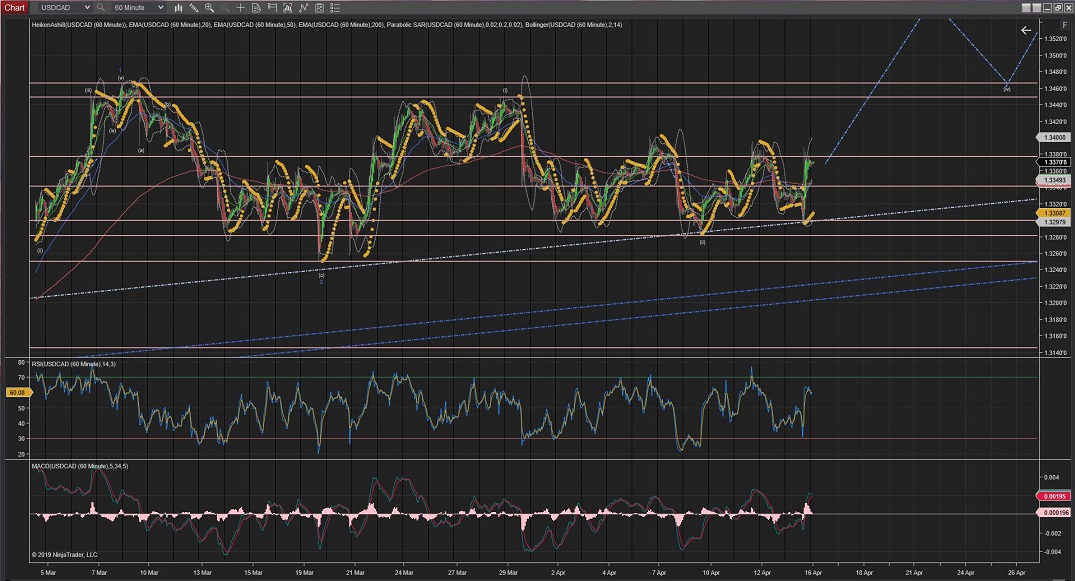

USDCAD

USDCAD correction of Wave (ii) completed at the %76 Fib levels.

Since then it has moved up sideways within a range of roughly 100 pips in a corrective manner for Wave (ii) of Wave 3(blue).

I have been expecting Wave (iii) to start gaining momentum and cross the highest of previous Wave (i) and maybe it is now about to come the end of this correction for the prices to start raising impulsively.

Wave (iii) will be confirmed when it crosses the highest of Wave (i) at 1.3450 and carries the price higher.

60Mins

4Hours

Daily

USDCHF

USDCHF Has been and still is grinding through a trend (yellow) to the upside but there is not clear defined Waves that I can label other than a 'raising correction'.

The move has shown some impulsive moves to the upside but I haven't change the current count as I still consider the move corrective in nature (not defined impulsive waves) and there could be a final drop towards the long-term trend line.

If the price carries on upwards through the resistances in the form of 5 clear waves it will indicate that Wave c of Wave (c) of Wave [ii] has been already completed and this is the start of the series of waves for Wave [iii].

If the price drops lower again towards the lower trend (blue), the current count would still be valid for an extended Wave c.

Regardless of the starting point for the raise, on the long term, the price is bound to raise impulsively for Wave [iii]; best seen in the Daily Chart.

60Mins

4Hours

Daily

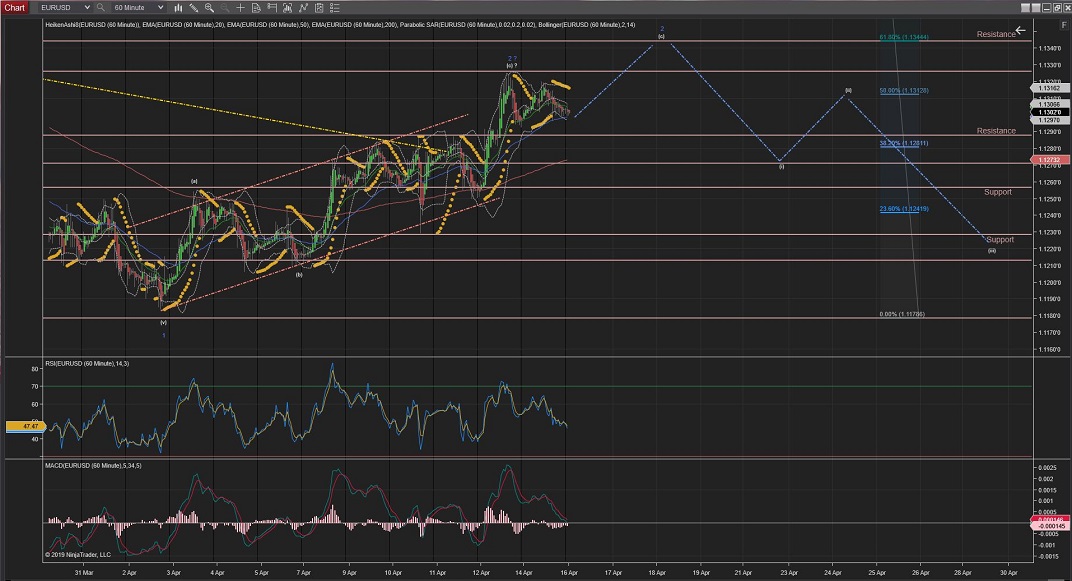

EURUSD

EURUSD made a move for a larger Wave 2 correction and reversed slightly between %62 and %50 retracement of Wave 1.

The move down could be Wave 3 of Wave iii initial impulsive wave to the downside.

But, unless the impulsive waves to the downside confirm Wave 3, there is indications of an extended Wave 2 correction towards the %62 retracement at the 1.13444 area.

And, bearing in mind that the alternative count for Wave [ii] to continue to the upside is still present (best seen in the Daily chart).

Next, as per current count, Wave 3 should continue to move down impulsively across the trend line (light-red) and support levels.

60Mins

4Hours

Daily

EURCHF

EURCHF might have completed Wave v up at 1.13532 and that would complete Wave (i).

If this is not the end of Wave (i), and Wave v gets extended, the price could find the next resistance area at the 1.1386 area.

Next, Wave (ii) should carry the price lower towards support levels, possibly to the lowest of previous Wave iv (1.1281 - next to %38 retracement), although the next big area of support after that would be around the %50 retracement area (1.1255).

Note how Wave (ii) correction would create a beautiful Cup & Handle pattern for Wave (iii) to take the price extensively higher.

60Mins

4Hours

Daily

EURGBP

EURGBP is extending Wave ii towards the %76 retracement of Wave i, with the last internal 5 waves about to complete at 0.8665 area.

Note: The daily chart also shows an alternative count for a larger Wave [ii] to extend further up to.

As for the current count; If correct, Wave 3 should continue the waves down, once Wave ii completes, taking the price below the lowest of Wave 1 at 0.8500.

60Mins

4Hours

Daily

Weekly

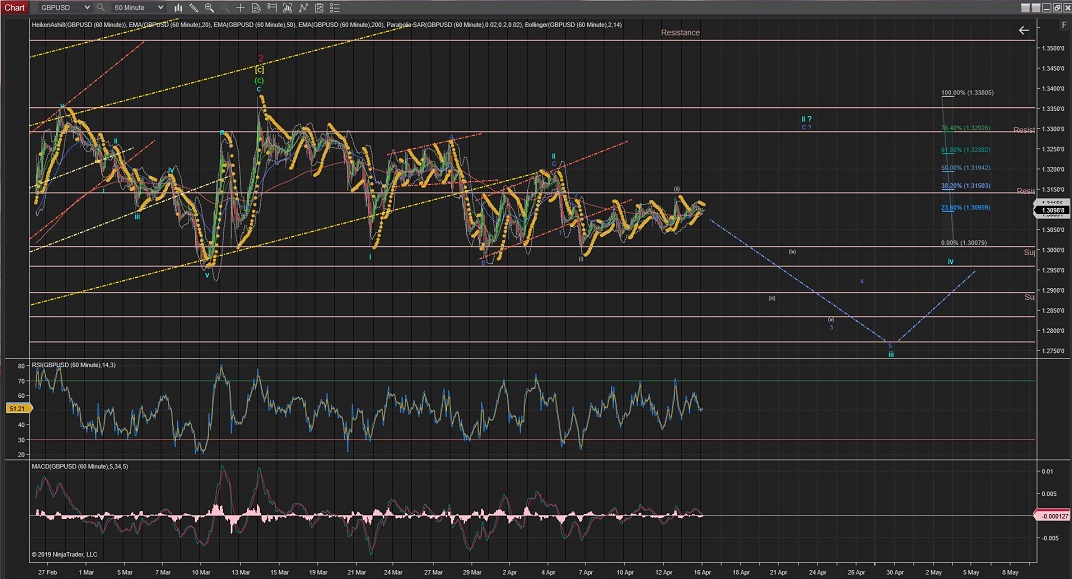

GBPUSD

GBPUSD is been moving sideways undecisevely to what might be Wave (ii) correction of Wave 3 of Wave iii on a downtrend.

Note: if the price crosses higher than the highest of Wave (i) it would trigger the alternative count of a Wave ii to be still in play and price could raise towards resistances at the 1.3300 area again

Also, the Daily Chart shows an alternative count for an Extended Wave [c] correction to complete Wave 2(red) at the %50 retracement level (1.35128 area).

As per current count, Wave iii will be confirmed when/if the price crosses the lowest of Wave (i) at the 1.3000 level area.

60Mins

4Hours

Daily

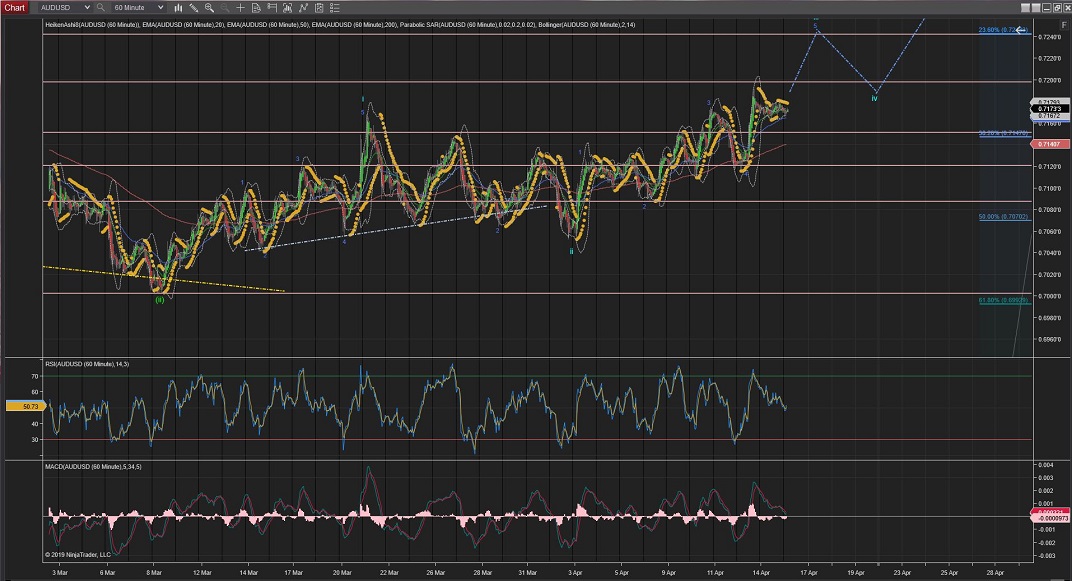

AUDUSD

Daily & 4Hour Charts:

AUDUSD 4Hour Chart is showing the price raising from the neckline of a clear Head & Shoulders pattern which is suggesting Wave (iii) could be finally making its way up.

Still not out of the woods yet, so further moves lower than this neckline would trigger the alternative count for an extended Wave [ii] going towards the %76 levels of support, although it is still possible an extended Wave [v] or even a further extended Wave 5, with not much resistance levels to stop the move down (best seen in the 4Hour and Daily charts) .

Hourly Chart:

Next, Wave iii should continue the remaining of its 5 internal waves up, possibly to the next resistance level around the 0.7200 area.

From there, Wave 4 should do another correction in price before Wave 5 takes the price higher to complete Wave iii.

60Mins

4Hours

Daily

Weekly

All the best for everyone.

Andres